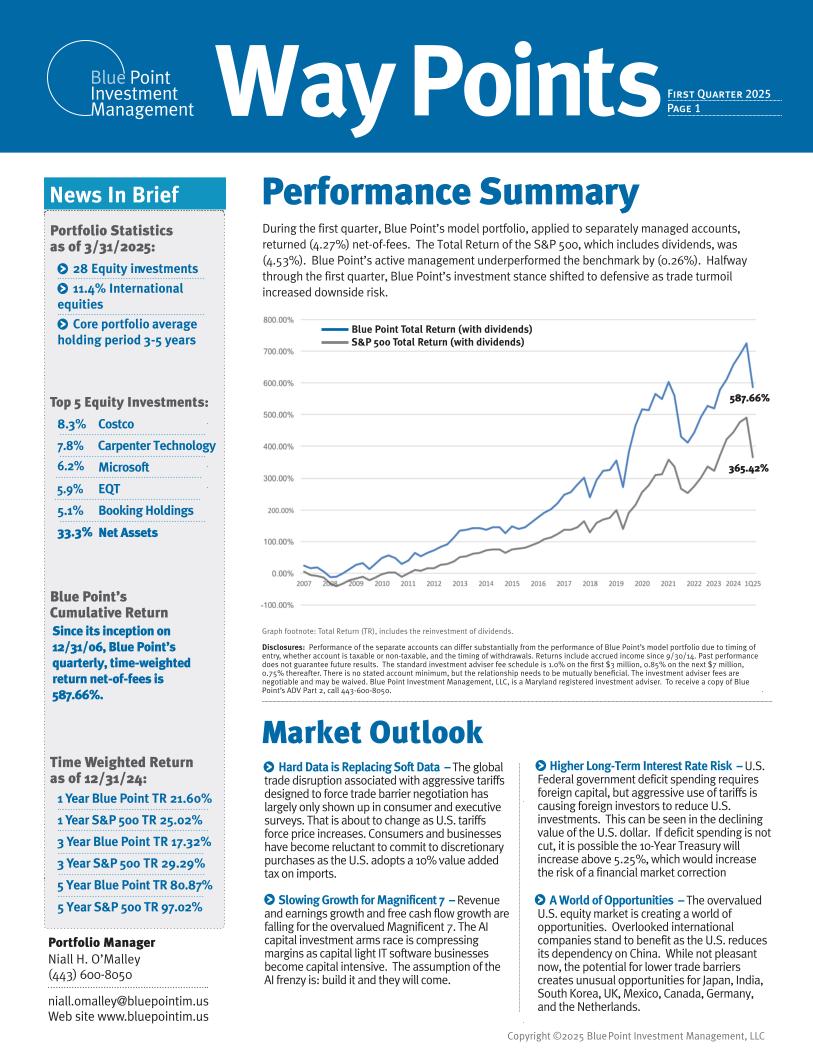

Way Points Quarterly

Read Current Issue

Sign-up for Email Updates

Receive Blue Point's quarterly commentary and related information.

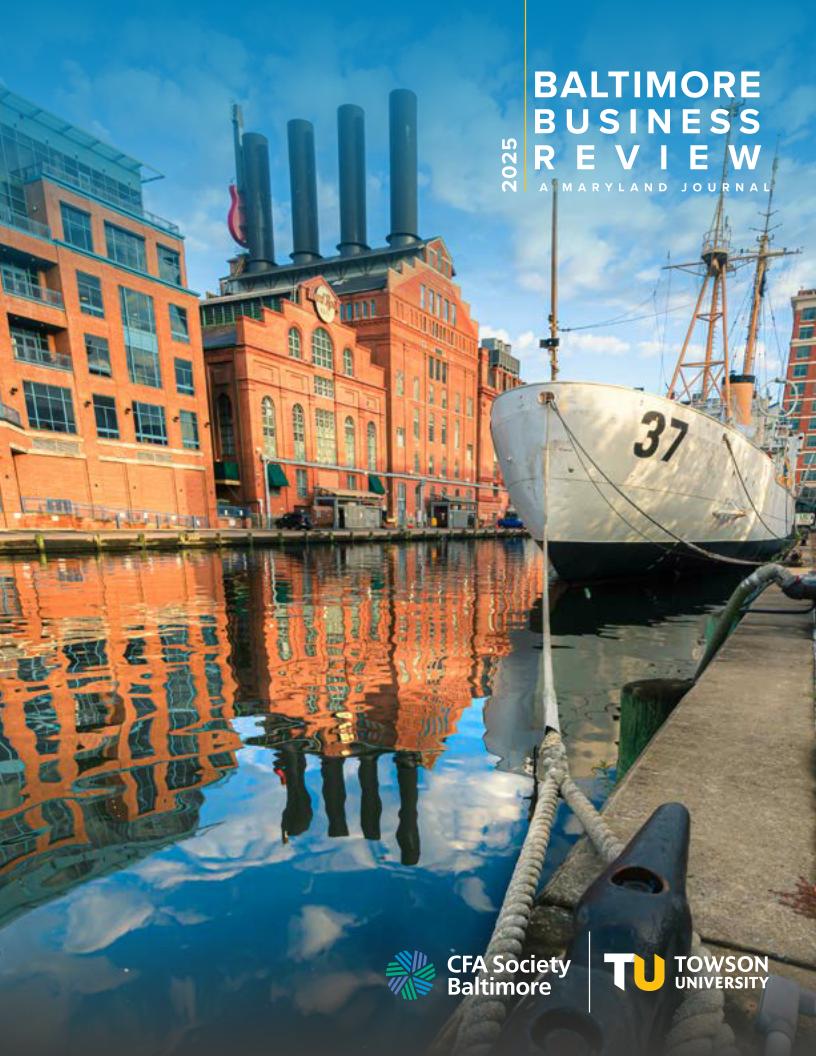

2025 Baltimore Business Review

January 24, 2025

Market Structure & Enhancing Returns

Oct. 8, 2015 | Presentation to CFA Society Virginia at Richmond's Center Stage