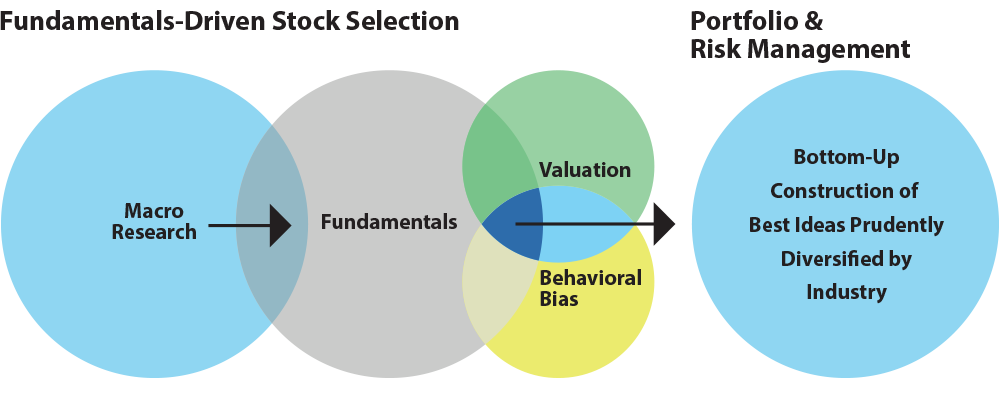

Our multi-layer investment approach combines a top-down screening process with fundamental, research-driven construction to build a portfolio of securities with the potential to offer superior risk-reward outcomes.

Blue Point uses a top-down investment approach to construct a portfolio of diversified securities. Through a multi-layer screening process, securities are identified which offer the potential for superior risk/reward outcomes. Blue Point goes beyond 90-days and takes a long-term orientation with a global perspective.

Screening Process:

- Through macroeconomic research, sustainable long-term trends are identified.

- Fundamental research is used to identify market leaders that are capable of capitalizing on the sustainable long-term trends.

- Analyze the company's cash flow, financial condition, and off balance sheet disclosures.

- Seek shareholder-oriented management teams which are focused on improving their return on capital.

- Evaluate the company's execution history and whether operating results are sustainable.

- Perform relative analysis to peers. Determine whether the company is undervalued relative to its potential growth.

- Confirm investment hypothesis with third party research while looking for evidence of institutional money inflows into issuer's securities.

- Look for opportunities where negative market sentiment creates an attractive entry point in the security of a fundamentally sound company.