January 24, 2025

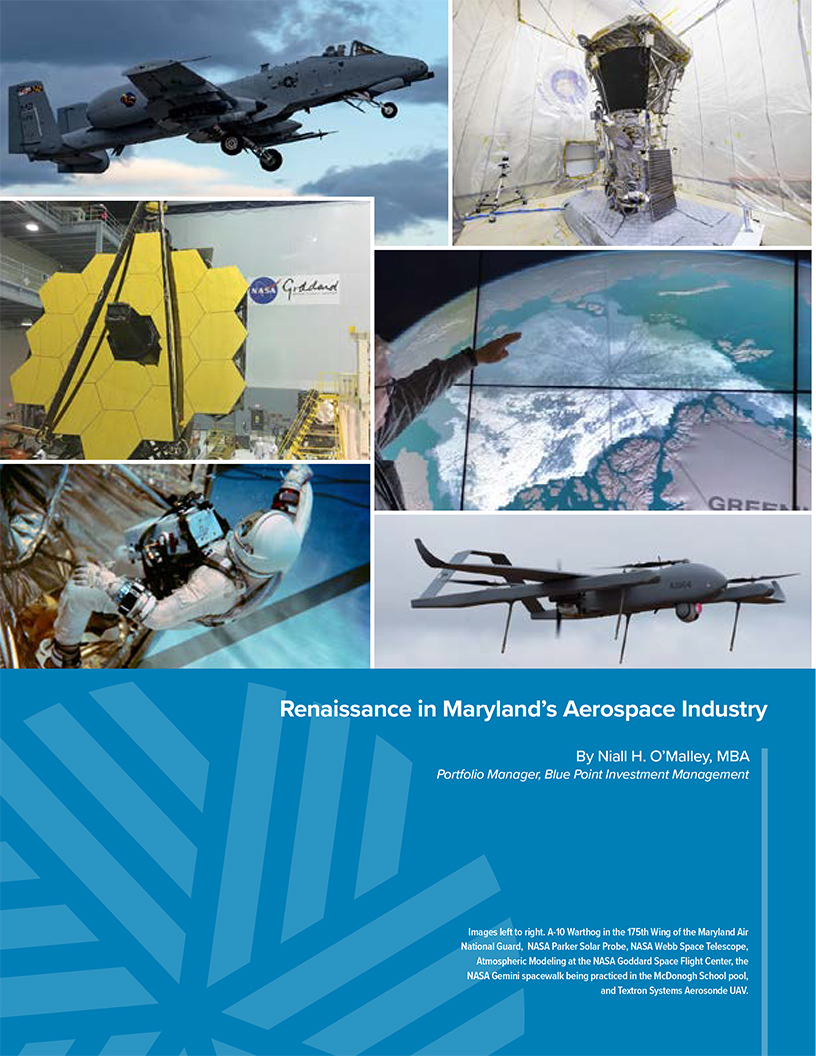

| By Niall O'Malley | Baltimore Business Review

Flight has fundamentally changed transportation and how we look at the world. Flight and air superiority brought an end to World War II and has become a cornerstone of our national defense.

January 24, 2025

| By Towson University and CFA Society Baltimore | Baltimore Business Review

The 2025 Baltimore Business Review: A Maryland Journal. A joint collaboration between the CFA Society Baltimore and the College of Business and Economics at Towson University. The publication is now in its 16th year.

January 31, 2024

| By Denise Lugo | Thomson Reuters Checkpoint Edge | FASB News

The FASB shold add another project to its agenda on the statement of cash flows because current rules cause analysts to overvalue technology companies that aggressively use stock-based compensation to pay employees, some say.

January 14, 2024

| By Niall O'Malley | Baltimore Business Review

How employees are paid at publicly traded U.S. technology companies has changed dramatically over the past 30 years, but the accounting rules associated with paying employees with stock rather than cash have not kept up with those changes.

January 12, 2024

| By Towson University and CFA Society Baltimore | Baltimore Business Review

The 2024 Baltimore Business Review: A Maryland Journal. A joint collaboration between the CFA Society Baltimore and the College of Business and Economics at Towson University. The publication is now in its 15th year.

February 20, 2023

| By Towson University and CFA Society Baltimore | Baltimore Business Review

The 2023 Baltimore Business Review: A Maryland Journal. A joint collaboration between the CFA Society Baltimore and the College of Business and Economics at Towson University. The publication is now in its 14th year.

February 8, 2022

| By Feng Yuquig | Financial Times China

Although most of the indicators point to a healthy economy, if it is not very strong, people begin to question the state of the economy. When the Fed raises interest rates rapidly, it will easily lead to market volatility.

January 22, 2022

| By Towson University and CFA Society Baltimore | Baltimore Business Review

The 2022 Baltimore Business Review: A Maryland Journal. A joint collaboration between the CFA Society Baltimore and the College of Business and Economics at Towson University. The publication is now in its 13th year.

February 21, 2020

| By Niall O'Malley | Baltimore Business Review

A good investment becomes a bad investment when it becomes evident to the buyer that they overpaid. This concept applies not only to individual investors, but also in the case of share buybacks, when a company overpays for shares. Typically, share buybacks are used by a company to return earnings to shareholders.

January 10, 2019

| By Niall O'Malley | Baltimore Business Review

These are two of the most important questions in my conversations with investors as I write this article in September 2018. The U.S. equity markets have posted positive returns in each of the past nine calendar years. This is only the second time over the past century that equities have posted gains for nine consecutive years.

July 11, 2018

| By Radio Interview | Money, Riches & Wealth

On June 6, from 6 to 7 pm, Money, Riches & Wealth welcomed Blue Point Portfolio Manager Niall O'Malley. They discussed where to invest in this turbulent year of 2018.

March 22, 2018

| By Madeline Hahn | IES Abroad

Meet Niall H. O’Malley (IES Abroad Vienna | 1989-90), Founder and Portfolio Manager of Blue Point Investment Management, LLC, and our March Alum of the Month. Before embarking on his year abroad in Vienna, Niall never expected to witness the history that was about to unfold - from the fall of the Berlin Wall to the Velvet Revolution in Czechoslovakia to the Romanian Revolution. His experience inside the classroom was also

transformational.

January 10, 2018

| By Niall O'Malley | Baltimore Business Review

Technology companies are one of the most challenging industry sectors of the economy in which to invest. The risk of failure is above average. New technologies require huge amounts of capital investment before they realize their revenue potential, so the investor bears the cost of building before customers come. Further, valuations are enormous, and the profits are often nowhere to be found. The challenge is identifying the public companies that will offer innovations that will gain acceptance, be perceived as value-added products or services, or even become essential to daily life.

January 10, 2018

| By Niall O'Malley | Baltimore Business Review

This piece was produced jointly by the CFA Society Baltimore and the Towson University College of Business and Economics. It was co-edited by Niall O'Malley, who serves as program committee and board member for CFA Society Baltimore. O'Malley also wrote "Why are Technology Companies So Difficult to Invest In?" starting on page 12.

October 17, 2017

| By Holden Wilen | Baltimore Business Journal

Randy McMenamin went into work on Oct. 19, 1987, ready to buy stocks. By the end of the day, he was telling himself, "Holy you know what."

Thirty years later, Black Monday still remains the biggest single-day stock market collapse.

January 11, 2017

| By Niall O'Malley | Baltimore Business Review

In recent history, Baltimore has been challenged by a lack of economic opportunity, but that need not be the case moving forward. One of the most effective ways to enhance economic opportunity is to understand the region’s natural resources and then invest in these natural advantages.

January 29, 2016

| By Carrie Wells | Baltimore Sun

U.S. stock markets swooned in the new year amid fears that an economic slowdown in China would spill over into domestic recession and as oil prices plummeted. Yet for some of the Baltimore region's largest public companies.

January 7, 2016

| By Niall O’Malley | Baltimore Business Review

Sometimes a simple question does not have a simple answer. To understand the role of short selling, one has to step back and try to understand how short selling impacts price discovery in equity markets. We are familiar with the terminology short squeeze.

January 5, 2015

| By Niall O’Malley | Baltimore Business Review

Before delving into the limitations and unintended consequences of Exchange Traded Funds (ETFs), it is important to define an ETF. Where did these investment vehicles originate? How significant are ETFs to investors? The first Exchange Traded Fund was launched in January 1993.

January 7, 2014

| By Niall O’Malley | Baltimore Business Review

As an investment manager, I seek investments with sustainable growth. I have the freedom to look anywhere in the world. Quietly, the U.S. has developed a competitive advantage in energy costs that is rewriting the history books.

July 9, 2013

| By Rob Daly | Trade News

Having lurched from flash crash to hash crash over the last three years, is the US equities market structure sound enough for the coming correction? When Belfast locals discuss the city's relationship with the doomed RMS Titanic, they often joke: "She was fine when she left here."

May 9, 2013

| By Niall O’Malley | CityBizList

There is no known parallel to Warren Buffett's Annual Meeting. What would possess 35,000 people to travel from around the world for the meeting?

April 16, 2013

| By Gary Haber | Baltimore Business Journal

The stock market rebounded Tuesday after Monday's sharp sell-off following the fatal bomb blasts at the Boston Marathon. The three major indexes - the Dow Jones Industrial Average, NASDAQ and Standard & Poor's 500 - all climbed higher Tuesday as did major Baltimore-area stocks.

February 4, 2013

| By Nina Mehta | Bloomberg

Twelve years after the U.S. switched to 1-cent increments for stock trading to save investors money, regulators and broker-dealers are considering a test of larger tick sizes. A pilot study of bigger quoting increments to improve liquidity in less-active stocks will be debated by executives from exchanges and brokers, and market makers.

August 10, 2012

| By Jamie Hopkins | Baltimore Sun

Steel from Sparrows Point built the Golden Gate Bridge, the Chesapeake Bay Bridge, hundreds of ships for World War II and livelihoods for tens of thousands of Baltimore-area families. The story of the massive steel mill follows the arc of American manufacturing.

May 9, 2012

| By Niall O’Malley | CityBizList

This article originally appeared in CITYBIZLIST on May 9, 2012 The turmoil in the financial markets during the past four years has galvanized the need for a balanced approach in uncertain times.

January 3, 2012

| By Niall O’Malley | Baltimore Business Review

U.S. and Maryland manufacturing have receded for the past 40 years as cheaper emerging market manufacturing resulted in the wholesale relocation to the emerging markets. Outsourcing has been a persistent buzzword. There is growing evidence that manufacturing in the U.S. and Maryland is on the rise.

January 14, 2011

| By Gary Haber | Baltimore Business Journal

As the economy starts clawing itself out from the crater dug by the Great Recession, a portfolio manager at T. Rowe Price thinks the nation's biggest companies are in the best position to take advantage of the turnaround.

January 5, 2011

| By Niall O’Malley | Baltimore Business Review

As income levels grow, emerging market consumers become a more important force in creating an opportunity for Maryland based companies. To understand the recent changes in the consumer market it is helpful to step back and look at the recent role of the emerging markets.

September 20, 2010

| By Gary Haber | Baltimore Business Journal

Greater Baltimore stocks took a beating in the market's near collapse two years ago - and some have yet to recover. The region's 10 biggest publicly traded companies lost a combined $2.7 billion in market value since Lehman Brothers' bankruptcy filing on Sept. 15, 2008.

April 23, 2010

| By Scott Dance | Baltimore Business Journal

The Dow Jones Industrial Average closed above 11,000 for the first time in more than a year and a half April 12 — marking a return to a height not seen since a tumultuous September 2008 that shook Baltimore and Wall Street. But can the same be said for local stocks?

April 9, 2010

| By Heather Harlan Warnack | Baltimore Business Journal

This is an interview with the Portfolio Manager, Niall O'Malley which was originally published in the Baltimore Business Journal. "Niall O'Malley has impeccable timing. The businessman began seeing the cracks in the American economic system three years ago and decided to leave his job as vice-president..."

January 5, 2010

| By Niall O’Malley | Baltimore Business Review

There are many ways to look at investments. As a portfolio manager, I use growth at a reasonable price (GARP) as a framework to shape my observations.

December 8, 2008

| By Niall O’Malley | SEC Comment Letter

Synchronized global deleveraging and cash hoarding are creating overstated capital shortages as fair value increasingly deviates from intrinsic value.